Protecting your car and your peace of mind starts with understanding your insurance options. Full coverage car insurance offers a comprehensive safeguard, combining collision, comprehensive, and liability protections to keep you financially secure from accidents, theft, and unexpected damages. Unlike basic liability coverage, full coverage ensures that you’re prepared for a wide range of scenarios, whether you’re driving your everyday vehicle, renting a car for a trip, or protecting a new investment.

Knowing what full coverage car insurance covers and what it consists of is essential for making informed decisions and avoiding costly surprises. From collision and comprehensive protection to rental car insurance options through providers like AAA or Amex, this type of policy offers a practical safety net for drivers.

Take the first step toward complete peace of mind on the road, get a quote today, and explore the options that best fit your driving needs, lifestyle, and budget.

Understanding What Full Coverage Car Insurance Is

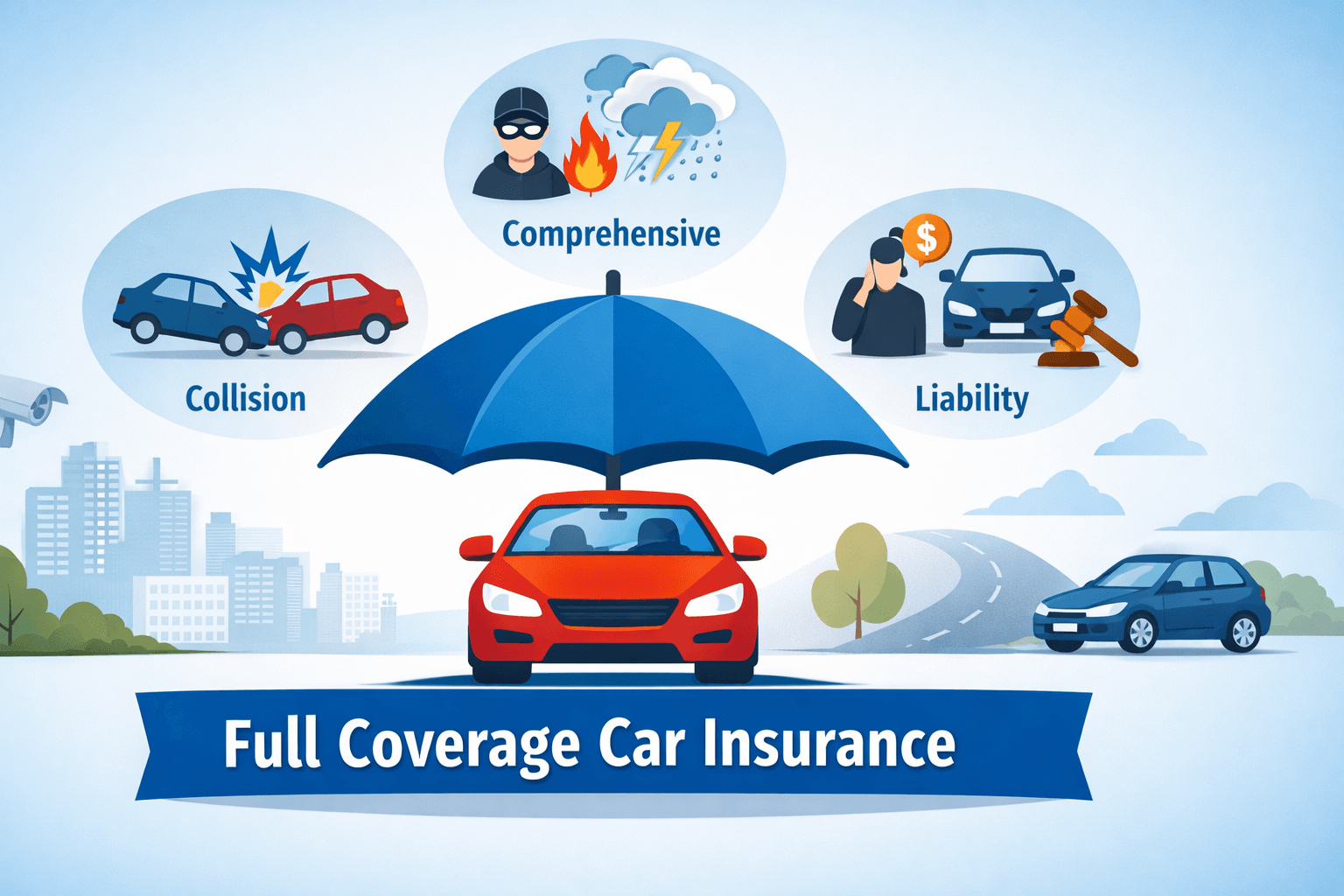

In the insurance industry, the term "full coverage" is frequently used by consumers, though it is not a specific policy type recognized by carriers. When drivers ask what full coverage in car insurance is, they are generally referring to a combination of policies that provide a high level of financial protection. Typically, this includes state-mandated liability insurance paired with elective physical damage protections.

The primary objective of this comprehensive approach is to bridge the gap between basic legal compliance and total asset protection. While basic liability only covers damages you cause to others, car insurance with full coverage accounts for your own vehicle’s repair or replacement costs. This distinction is vital for anyone driving a newer vehicle or those who lack the liquid savings to replace a car out of pocket following a major incident. By maintaining this level of protection, you shift the financial burden of repairs from your personal savings to the insurance provider, ensuring that your mobility is preserved regardless of the circumstances on the road.

Key Components of Full Coverage Car Insurance

To understand the scope of a policy, one must look at what full coverage car insurance consists of. It is an umbrella term for a bundle of three distinct coverage types that work in tandem to provide a safety net. Together, these elements form the core of what most professionals consider a "full" policy. Without car insurance collision coverage, you are effectively self-insuring the value of your own vehicle, which can be a risky financial strategy in high-traffic environments or areas prone to severe weather.

Liability Insurance: The Legal Foundation

Liability insurance is the cornerstone of any automotive policy and is mandated by law in nearly every state. It is designed to provide financial protection for damages you may cause to others while operating your vehicle. This coverage is divided into two primary categories: bodily injury liability, which covers medical expenses and legal fees if someone is hurt, and property damage liability, which pays for repairs to another person's vehicle or property, such as a fence or storefront. Understanding Auto Insurance fundamentals shows that while this is the most common coverage, it is only one piece of a complete protection plan; it notably provides zero financial assistance for repairs to your own car.

Collision Coverage Explained: Protecting Your Asset

Car insurance collision coverage is the specific component that pays to repair or replace your vehicle if it is damaged in an impact, regardless of who is at fault. This includes hitting another car, a guardrail, or even a tree. It also covers "single-car" accidents, such as a rollover. For drivers with newer vehicles or those who still owe money on a vehicle loan, this coverage is often non-negotiable, as lenders require it to protect their investment. Without it, an at-fault accident could leave you without a vehicle and still responsible for a monthly loan payment.

Comprehensive Coverage Explained: Protection Beyond Accidents

Comprehensive coverage car insurance, often referred to as "other than collision," covers damage caused by events that are typically outside of a driver’s control. This includes a wide array of risks such as theft, vandalism, fire, and falling objects like tree limbs or debris. It is also the primary protection against weather-related incidents, such as hail, floods, or hurricanes. Because these risks are unpredictable and often result in a total loss of the vehicle, comprehensive coverage is considered the primary mechanism for mitigating non-driving-related financial disasters.

How Full Coverage Protects Against Theft and Damage

One of the most significant advantages of high-tier protection is the inclusion of insurance coverage for stolen car scenarios. If your vehicle is stolen and not recovered, or recovered in a damaged state, comprehensive coverage reimburses you for the vehicle's actual cash value.

Furthermore, modern travel often involves the use of temporary vehicles. Many drivers are unaware that their primary policy may extend to rentals. For example, AAA auto insurance coverage for rental cars often provides seamless protection that mirrors your personal policy limits. Similarly, those who utilize premium credit cards may have access to Amex rental car insurance coverage or American Express car rental insurance coverage, which acts as secondary protection to cover deductibles.

When a loss occurs, whether through theft or a rental mishap, documented proof and a timely police report are essential. Providers like State Farm insurance rental car coverage simplify this process by offering streamlined claims adjustments, but the level of reimbursement always depends on whether you have maintained AAA rental car insurance coverage or similar endorsements on your primary file.

Coverage Type | What it Protects | Is it Mandatory? |

Liability | Others' injuries and property | Yes (Most States) |

Collision | Your car (accidents) | No (Unless Leased/Financed) |

Comprehensive | Your car (theft, fire, nature) | No (Unless Leased/Financed) |

Uninsured Motorist | You (if hit by an uninsured driver) | Varies by State |

Full Coverage vs. Liability Car Insurance

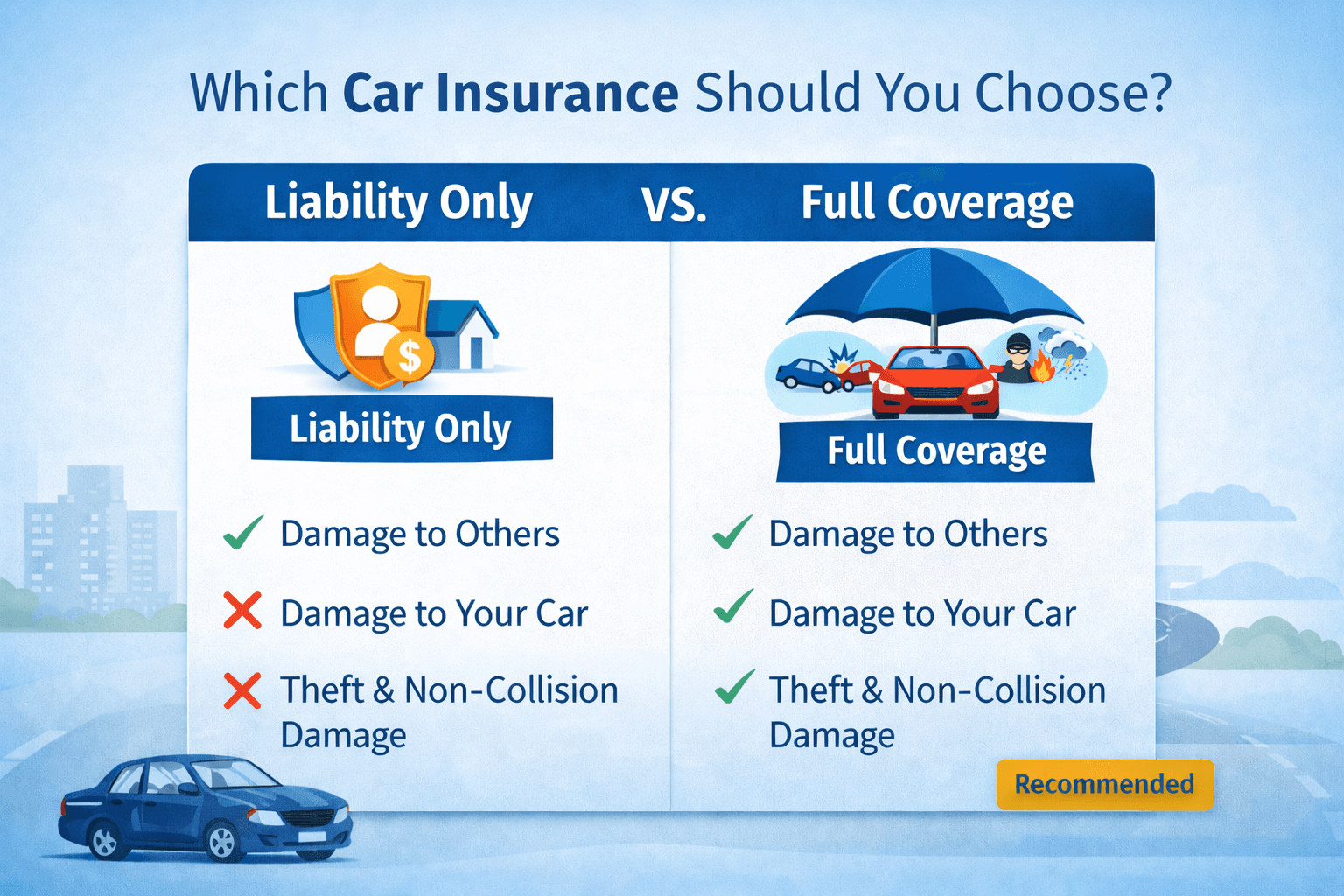

The debate of full coverage vs liability car insurance centers on risk tolerance and vehicle value. Liability insurance is the bare minimum required to drive legally. For instance, the minimum car insurance coverage California requires is notably lower than what is necessary to actually replace a modern vehicle. Relying solely on the minimum can leave a driver personally liable for tens of thousands of dollars in repair costs.

In the comparison of liability vs full coverage car insurance, the latter is almost always required by lienholders if you are financing or leasing a vehicle. Lenders require this to protect their collateral. However, even if you own your car outright, full coverage is recommended if the cost of replacing the vehicle would cause you significant financial hardship. Conversely, if you drive an older vehicle with a low market value, the premiums for physical damage coverage might eventually exceed the potential payout, making liability-only a more pragmatic choice.

Choosing the Best Full Coverage Car Insurance in Your State

The definition of the "best" insurance policy is rarely universal; rather, it is a regional calculation heavily influenced by state-specific mandates, local repair labor rates, and regional environmental risks. For residents of the West Coast, finding the best full coverage car insurance in California involves a complex balancing act. Drivers must weigh higher-than-average premiums against the critical need for robust uninsured motorist protection, as the state has a significant percentage of drivers operating without valid policies. Automobile Insurance Information Guide resources emphasize that while minimums are low, full protection is the only way to safeguard your assets in high-traffic corridors like Los Angeles or the Bay Area.

In other regions of the country, the consumer focus often shifts primarily toward affordability and navigating unique state insurance systems. For instance, drivers searching for cheap full coverage car insurance in Florida must navigate a "no-fault" state system, which often drives up base costs, making it essential to compare regional carriers who understand the local litigation landscape. Similarly, identifying the cheapest full coverage car insurance in Ohio often leads drivers to local mutual insurance companies or specialized regional branches of national firms that offer competitive multi-policy discounts.

The search for value continues across the Sun Belt and the South. Those seeking cheap full coverage car insurance in SC or cheap full coverage car insurance in AZ should be wary of choosing a provider based solely on the lowest monthly premium. In states prone to extreme weather, such as South Carolina’s hurricane risks or Arizona’s intense monsoon seasons, the quality of a carrier’s claims department is paramount. A policy is only as effective as the company’s willingness and ability to process a claim efficiently during a widespread crisis. Therefore, prioritizing companies with high claims-satisfaction ratings ensures that "cheap" coverage doesn't become a costly mistake when it's time to rebuild or replace your vehicle.

Understanding Full Coverage Costs and Affordability Tips

Many factors influence the cost of full coverage car insurance, and in 2026, these variables are more complex than ever. Beyond basic demographics, insurance carriers utilize "credit-based insurance scores" to predict risk. Statistically, drivers with higher credit scores are viewed as more financially stable and less likely to file a claim, often resulting in premiums that are significantly lower than those with poor credit. Additionally, the specific make and model of your vehicle play a vital role; high-tech vehicles equipped with advanced sensors and lithium-ion batteries often command higher premiums due to the specialized labor and parts required for repairs.

While a comprehensive policy is inherently more expensive than basic liability, there are several professional strategies to manage these expenses:

Strategic Deductible Adjustments: Increasing your deductible from $500 to $1,000 can reduce the collision and comprehensive portions of your premium by as much as 15% to 30%. This is an effective way to secure cheap full coverage car insurance in Florida or other high-premium states, provided you maintain an emergency fund to cover the out-of-pocket cost if a claim arises.

Leveraging Secondary Benefits: If you are a frequent traveler, check your financial tools before paying for add-ons. Utilizing Amex rental car insurance coverage benefits allows you to decline the rental agency's expensive collision damage waiver (CDW), saving you significant daily fees.

The Power of Bundling: Combining your auto policy with homeowners, renters, or life insurance remains one of the most effective ways to lower the overall cost of car insurance what is full coverage. Most national carriers offer multi-policy discounts ranging from 10% to 25% across all bundled lines.

Usage-Based Insurance (UBI): For low-mileage drivers or those with safe driving habits, enrolling in a telematics program can lead to substantial discounts. These programs monitor braking, acceleration, and total mileage, offering a personalized rate that can be much lower than standard actuarial estimates.

By proactively reviewing these factors annually, drivers can maintain maximum protection without overpaying for their security on the road.

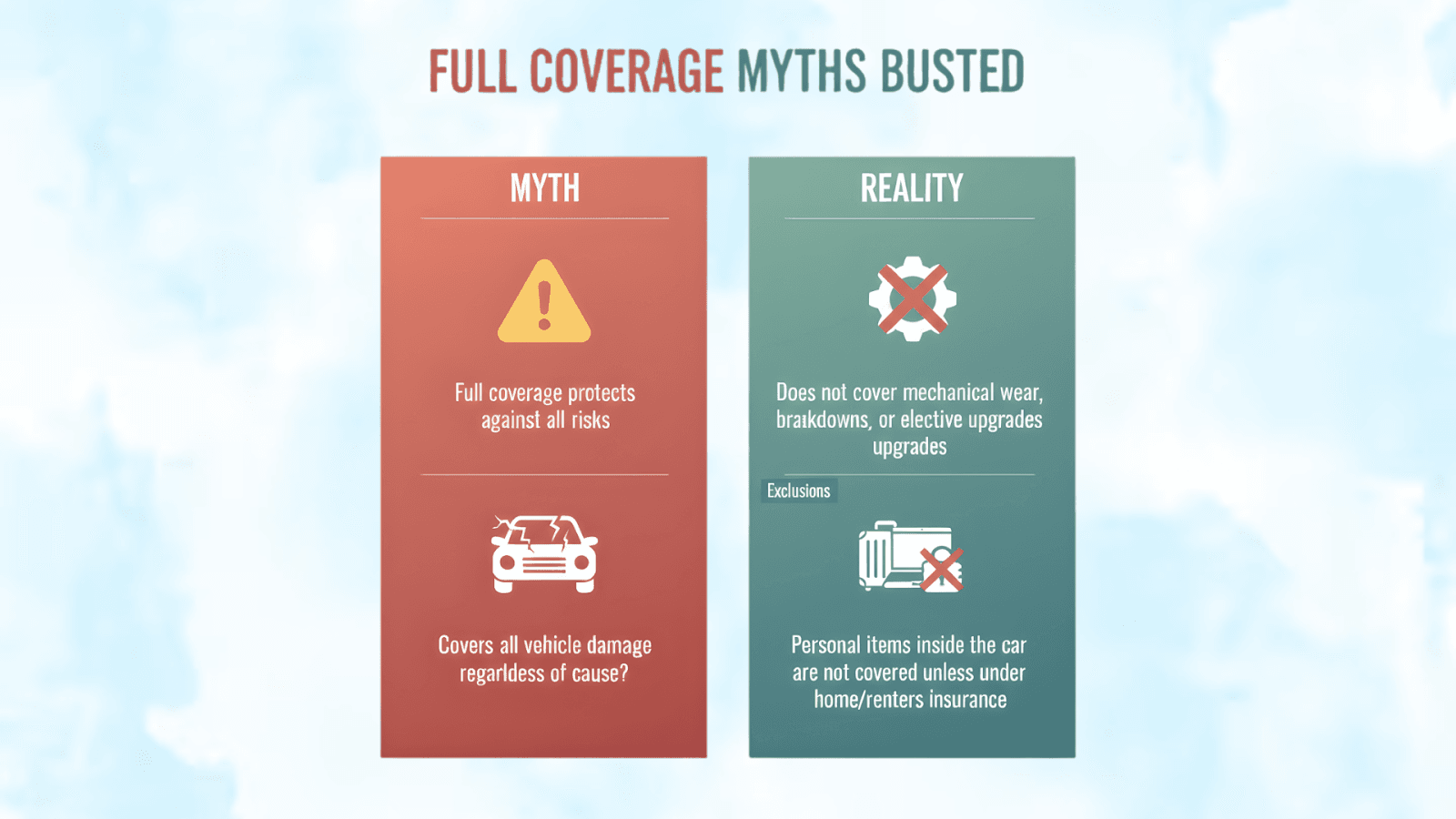

Common Misconceptions About Full Coverage Insurance

The term "full coverage" is often at the center of significant legal and financial misunderstandings. One of the most prevalent myths is that this level of protection covers every possible scenario on the road. In reality, there is no single policy that offers 100% protection against all risks. For instance, what is full coverage insurance on a car typically excludes mechanical breakdowns, wear and tear, and elective upgrades unless specific riders are added.

Another common confusion involves regional specifics, such as what full coverage car insurance is in California. Many drivers in the Golden State believe that "full coverage" automatically includes roadside assistance or glass replacement. However, these are often optional add-ons. Furthermore, drivers often assume their personal belongings inside the car are covered under the auto policy; in truth, items like laptops or luggage are usually only protected under a homeowners or renters policy. Understanding these boundaries ensures that you are not left with unexpected out-of-pocket expenses during a claim.

Full Coverage for Rental Cars and Temporary Vehicles

Navigating insurance requirements at a rental counter can be daunting, but a robust personal policy often provides the necessary safeguards. Most "full" policies extend your existing liability, collision, and comprehensive limits to a rental vehicle of similar value. For many, AAA rental car insurance coverage serves as a reliable primary or secondary shield, often including benefits that cover "loss of use" fees, charges a rental company may levy while a vehicle is being repaired.

Additionally, premium financial products can further reduce costs. Amex rental car insurance and American Express car rental insurance are frequently used by professionals to avoid the daily collision damage waiver (CDW) fees. However, it is essential to verify if your provider, such as State Farm insurance rental car coverage, requires you to notify them before traveling internationally. Always confirm the specific terms of your policy to ensure that your "full" protection travels with you across state lines and borders.

Comparison of Rental Car Protection Sources

Feature | Personal "Full Coverage" Policy | AAA Auto Insurance | Amex/Credit Card Coverage | Rental Counter (CDW/LDW) |

Primary/Secondary | Primary | Usually Primary | Often Secondary | Primary |

Liability Limits | Same as a personal car | Same as a personal car | None (Damage only) | Varies by state |

Theft/Vandalism | Covered | Covered | Covered | Covered |

Loss of Use Fees | Often excluded | Frequently included | Varies by card tier | Fully covered |

Best For | Daily driving | Member travelers | Frequent travelers | High-risk/International |

It is essential to verify if your provider, such as with State Farm insurance rental car coverage, requires you to notify them before traveling internationally or renting specialized vehicles like large moving vans. Always confirm the specific terms of your policy to ensure that your "full" protection travels with you across state lines and borders.

Expert Tips for Maintaining Continuous Coverage

Maintaining an active insurance history is one of the most effective ways to keep your long-term premiums low. Below are five frequently asked questions regarding coverage continuity and policy management.

What is the best car insurance after a lapse in coverage?

After a lapse, insurers view you as a higher risk. Companies like Progressive and Dairyland often specialize in high-risk "non-standard" policies. It is best to secure a policy immediately, even if it is more expensive, to start rebuilding your continuous coverage history, which typically takes six months to a year to normalize.

Can I get full coverage if I have a gap in my insurance history?

Yes, but expect higher premiums initially. Most carriers will offer you a policy, but you may be ineligible for "preferred" rates until you have maintained at least six months of active, uninterrupted insurance.

What does full coverage car insurance consist of?

Full coverage is a combination of three essential protections: Liability, Collision, and Comprehensive. Liability covers damages you cause to others, while Collision and Comprehensive work together to repair or replace your own vehicle following accidents, theft, vandalism, or natural disasters. Together, these components ensure you are protected against nearly all forms of financial loss on the road.

Does full coverage cover me if I’m driving someone else’s car?

Generally, insurance follows the car, not the driver. If you have permission to drive the vehicle, that car's policy is the primary coverage. However, your own full coverage may act as a secondary layer if the owner's limits are exceeded.

How can I avoid a lapse if I am between vehicles?

If you sell your car but plan to buy another soon, consider a "non-owner" policy. This provides liability protection and maintains your continuous coverage status, preventing the high rate hikes associated with an insurance gap.

Will my rates go down automatically after a lapse is "cleared"?

Not usually. You should proactively shop for new quotes once you have hit the 6-month or 12-month mark of continuous coverage. Most companies will not adjust your rate mid-term; you must request a re-evaluation or switch providers to capture the savings.

Professional Guidance for Maximizing Protection on the Road

Achieving maximum protection is not a "set and forget" task; it requires annual reviews and an understanding of what full coverage car insurance covers in the context of current market values. As vehicle repair costs rise due to inflation and advanced technology, your policy limits must keep pace. We recommend combining car insurance collision coverage with high liability limits, well above the state minimums, to protect your personal assets from litigation.

When comparing full coverage vs liability car insurance, remember that the price difference is a small premium to pay for the security of knowing a stolen or totaled vehicle won't derail your financial future. Always ask your agent about specific endorsements like "Gap Insurance" if you have a loan, or "New Car Replacement" for vehicles under two years old.

Ready to secure your vehicle with the industry's best protection? Get a free, no-obligation quote and drive with confidence today.